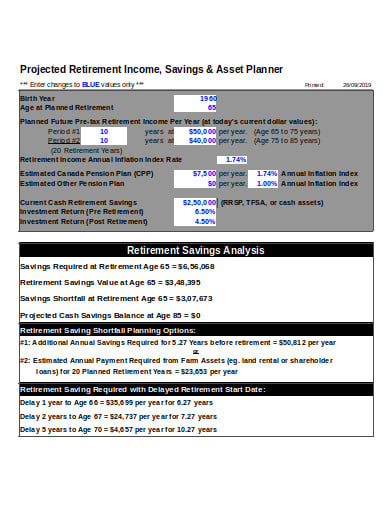

20+ Retirement estimator

Internal Revenue Code Section 415b imposes a dollar limit on the benefit amount the Maryland State Retirement Agency can pay from tax-deferred plan funds. Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

Regression Estimates Of Administrative Expenses On Pension Plan Download Table

COLA Increase for Fiscal Year 2023 Please be advised that the Bristol County Retirement Board has voted to approve a 3 Cost of Living Adjustment COLA.

. Depending on your age and service credit at retirement an age factor may be applied to your benefit calculation. Learn how this can be used as a source of retirement income. 0345 602 7021 Hours.

You decide how your account balance will be invested selecting from a variety of mutual funds and variable annuities. Because some members may retire at a relatively early age with a high percentage of highest average final compensation a few may encounter this limit. For other retirement plans contribution limits see Retirement Topics Contribution Limits.

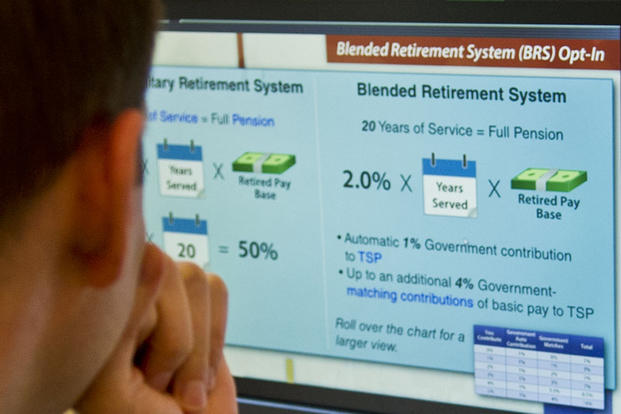

You might be able to increase your retirement income or even retire sooner than. Form 1099-G Certain Government Payments. For example 20 years of service would equal a 50 multiplier.

1-800-343-0860 Meet for free with a Fidelity Workplace Financial Consultant virtually from any location Go to our help page for more assistance options by topic. Flexible retirement income is often referred to as pension drawdown or flexi-access drawdown. RETIREMENT READINESS UCRP Benefit Estimator uses your personal information such as service credit and most recent payroll information to.

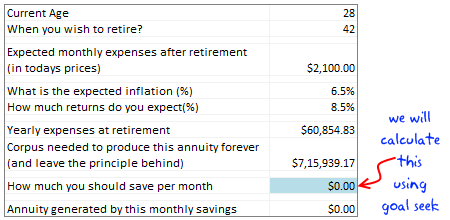

Comparing mortgage terms ie. This calculator uses your assumptions of. Social security retirement income estimator.

We set the default rate for before retirement at 575 and rate of return after retirement at 40 with a valid range of 0 to 20 for each. For 2022 2021 2020 and 2019 the total contributions you make each year to all of your traditional IRAs and Roth IRAs cant be more than. CalPERS builds retirement and health security for California state school and public agency members.

6000 7000 if youre age 50 or older or. The Advisory Council of the Bristol County Retirement Board and Chairman Christine N. As of June 2021 CalPERS income over the last 20 years demonstrates that every dollar spent on public employee pensions comes from the following sources.

We have a variety of calculators to help you plan for the future or to assist you with your needs now. If you retire prior to age 63 you will receive a reduced benefit without exception. Early retirement age 50 if vested and normal - age 55 if vested.

As of June 30. Any age with 30 years service or 20 years of policefire service. The SURS Retirement Savings Plan RSP is a defined contribution plan that establishes an account into which your contributions and the employer state of Illinois contributions are placed.

More than 66000 but less than 76000. If less your taxable compensation for the year. This checklist can help you successfully transition into retirement.

Calls from the UK are free. Dependents or Children under the age of 17. Under Tier 6 you would receive 35 plus 2 per year beyond 20 years if credited with more than 20 years of service.

UM retirement team. 573 882-2146 or retirementumsystemedu For voluntary options. Early retirement age 55 if vested and normal - age 60 if vested.

Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc Traditional IRA Contribution Itemized deductions statelocal and property taxes capped at 10000 - 0 for Standard. Single or head of household. Any age with 30 years service or 20 years of policefire service.

15 20 30 year Should I pay discount points for a lower interest rate. With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. Log in or create a secure myVRS online account.

Sat Sun and bank holidays. The birth event is the start of the individuals tenure and the death event is the retirement of the individual. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

Should I rent or buy a home. 44 20 7932 5780 For self-employed. And Your Modified AGI Is.

Then You Can Take. An online benefit estimator is available for members more than two years from retirement eligibility. Your personal my Social Security account gives you secure access to information based on your earnings history and interactive tools tailored to you.

Your human resource office can assist you with benefit estimates. We manage the largest public pension fund in the US. Your future retirement benefit is based on a three-part formula that considers your compensation years of credited service and a computation factor.

How does inflation impact my retirement income needs. The best way to start planning for your future is by creating a my Social Security account online. The years of service creditable are computed differently depending upon whether retirement is from full time active duty or from a reserve career.

You can also view retirement benefit estimates by. With my Social Security you can verify your earnings get your Social Security Statement and much more all from the comfort of your home or office. Form 1099-MISC Miscellaneous Income.

If you havent already sought financial planning advice now is a great time. You can also create benefit estimates through myVRS. The long term rate of investment return used by the Civil Service Retirement Fund Board of Actuaries is 575.

Consider the following data first 20 observations from 1808 observations. Censoring can occur if they are Still in offices at the time of dataset compilation 2008 Die while in power this includes assassinations. Retirement Planning Checklist Updated September 2020Print Version The earlier you begin planning for retirement the better prepared youll be.

20 years of service creditAt age 60 or 65 depending on your UCRP member tier youll be eligible to receive up to 50. If Your Filing Status Is. CalcXMLs Retirement Calculator will help you determine how much you need to save for your retirement.

DeFontes has authorized and. For both the Final Pay and High-36 retired pay plans each year of service is worth 25 toward the retirement multiplier. Before submitting a disability retirement application compare your estimated disability retirement benefit with your estimated service retirement benefit.

A full deduction up to the amount of your contribution limit. Tier II - Entered service after June 30th 1986 but before July 1 1996.

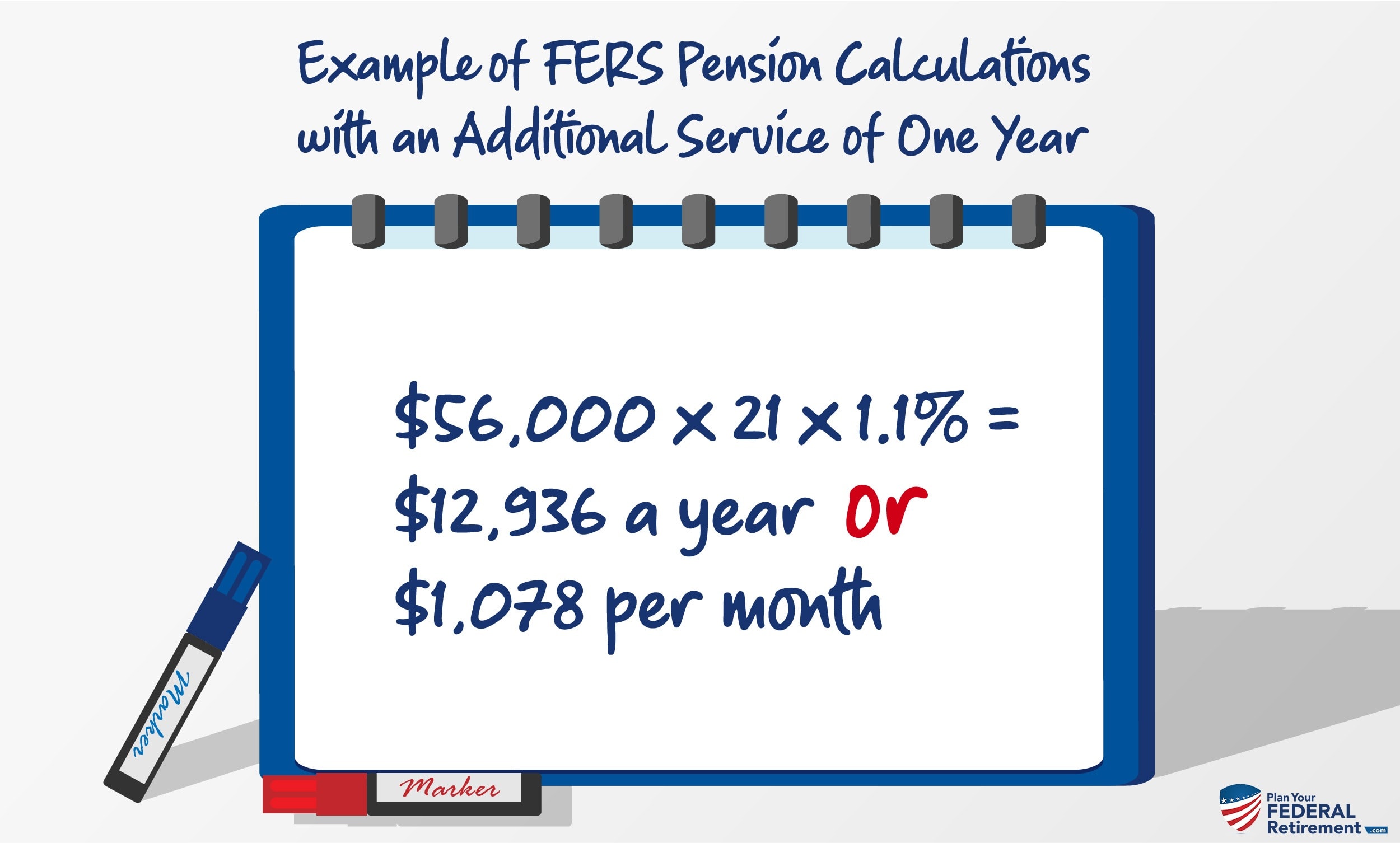

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

10 Free Social Security Calculators To Help You Plan Retirement

Pdf Retirement Plans And Saving Decisions The Role Of Information And Education

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-05-7a8167292d2d46409d2828ea87053be2.jpg)

Calculating The Equity Risk Premium

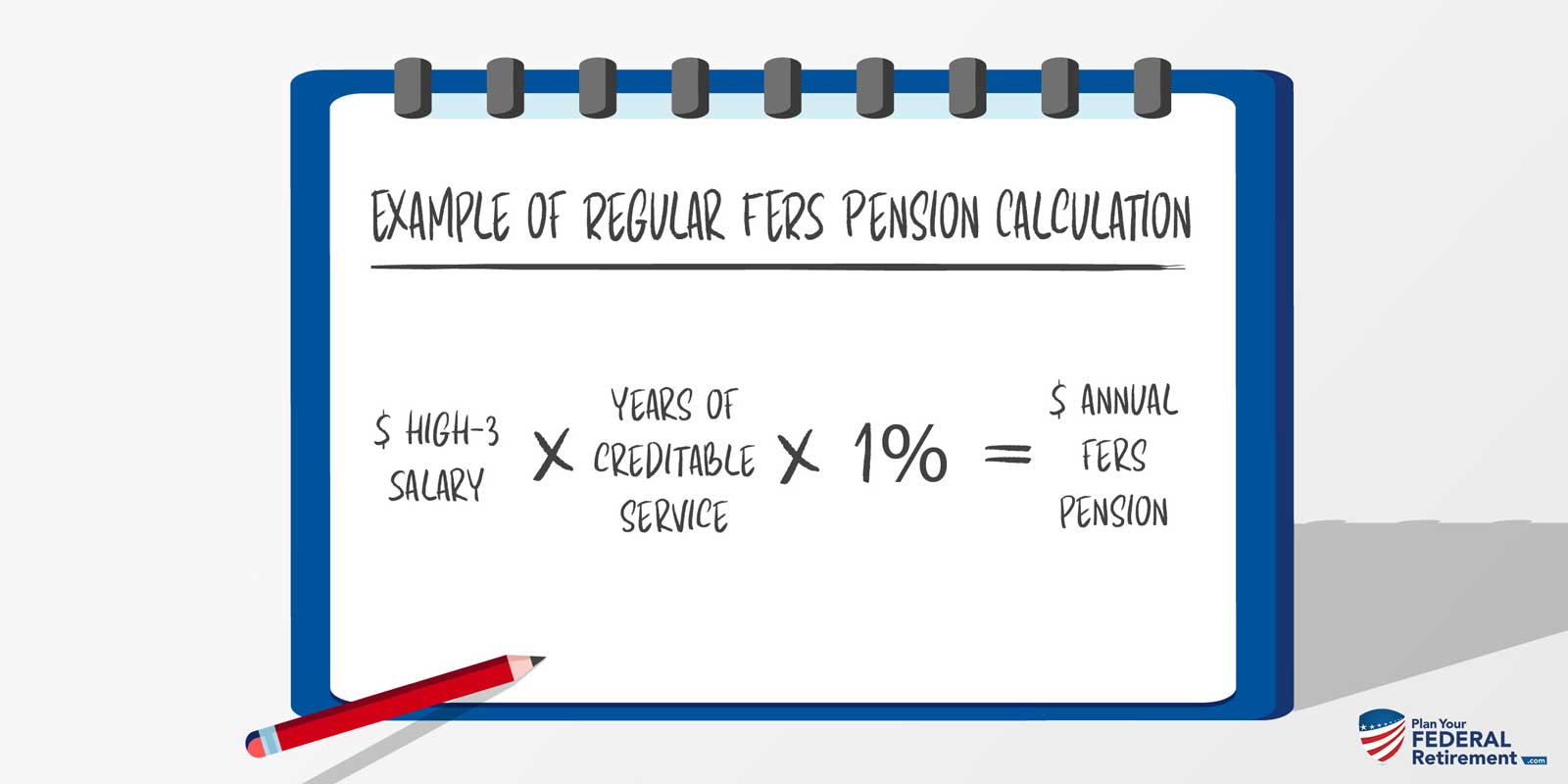

Computation Of Retirement Benefits Formula For Calculation Of Pensions Download Scientific Diagram

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

How To Plan For Retirement In 10 Years In Spite Of The Tough Market Ahead Seeking Alpha

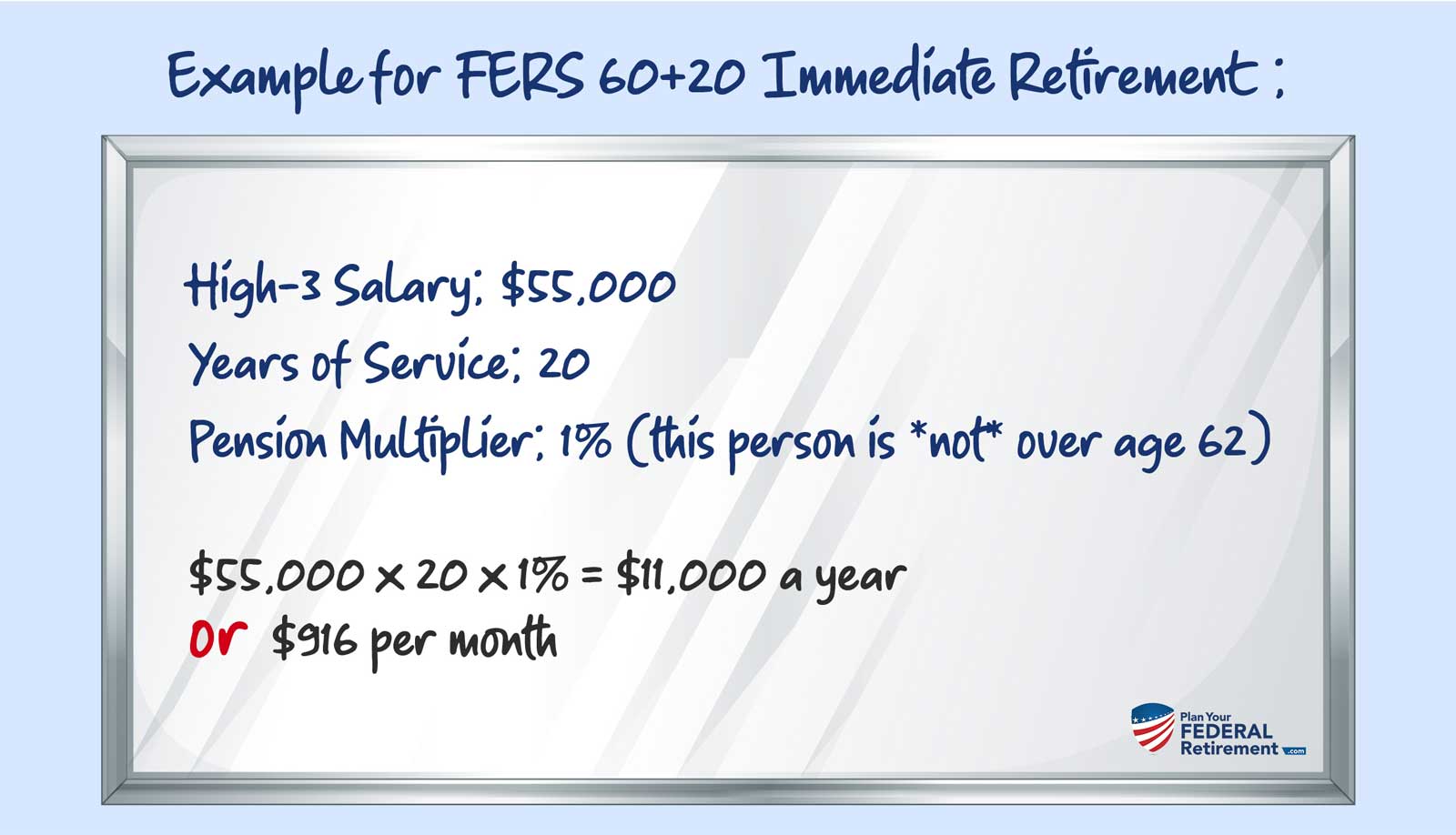

Fers Immediate Retirement Plan Your Federal Retirement

Computation Of Retirement Benefits Formula For Calculation Of Pensions Download Scientific Diagram

6 Retirement Income Calculator Templates In Xls Free Premium Templates

:max_bytes(150000):strip_icc()/dotdash_final_How_To_Convert_Value_At_Risk_To_Different_Time_Periods_Dec_2020-01-1a98d3db75024bbdac410a3be7185859.jpg)

How To Convert Value At Risk To Different Time Periods

The Blended Retirement System Explained Military Com

Excel Goal Seek Tutorial Learn How To Use Goal Seek Feature By Building A Retirement Calculator In Excel

Estimated And Derived Models Of Revenue Expenditure And Budget Download Table

The Realistic Investment And Retirement Calculator

Pension Calculator Retirement Planning Calculator 2 000 Clients